Buying tools and equipment

Clever buying of power tools, hand tools and woodwork tools for such as plumbers, electricians and carpenters and can only help when starting or keeping afloat a small business.

Below is a simple introduction to the acquisition of small to medium cost tools and equipment in order to complete your tasks. This does not cover purchases of materials that are consumed as part of the job for a customer.

From an accounting perspective, determining how to purchase tools and equipment and the tax advantages of each, can become quite complex.

You should therefore refer to an accountant for advice before making any final decisions.

The following is therefore designed for you to appreciate some of the variables and options when thinking intelligently about why and how you might acquire the tools and equipment you need.

Keep all receipts

Before we start, remember to keep all receipts for any tools or equipment acquired for the business. If you are not particularly organised then keep a cardboard box to flick the receipts into and let the accountant moan when its time to do the books. Just be sure to keep them.

File safely any warranties and guarantees.

Tools and equipment purchasing broadly falls into two categories: the items and the materials consumed by those items.

Equipment required to do the job

Examples: drills, cement mixers, computer printers.

Assessing the true expense of tools and equipment

Below is a summary of the costs you should know before making a decision.

- Cost of the item.

- Acquisition options – buy or lease.

- Cost if financing the item.

- Opportunity cost of not buying and instead using the money elsewhere in the business.

- Cost of recommended servicing.

- Cost of maintenance based on known reliability.

- Cost of consumables to keep the equipment running.

- Expected level of depreciation.

- Impact on your cash flow.

- Impact on your asset/liability ratio.

For small incidental purchases, this assessment might be overkill, but medium to large equipment purchases should be considered carefully. Consumables on all equipment will always impact profitability of jobs to some degree.

Methods of payment for tools and equipment

You may have a choice of whether to purchase the item or lease.

Purchase items

When you purchase items, these become assets to the business and appear on your balance sheet.

These assets will depreciate in value as you wear them out. Note that as far as accounting is concerned, there is an accounting method for depreciation – not closely aligned with physical depreciation.

You can purchase with one complete payment or depending on the value of the item, you might take a hire-purchase or loan agreement.

If you decide to finance and not take the cash payment option, then this will appear as a liability for your business on the balance sheet. This will steadily decrease as you pay it off. In effect, the asset on the balance sheet achieved by the purchase is therefore reduced on the other side of the balance sheet by the liability of the loan.

Single payment purchase considerations

- Watch the cashflow. This could be a sudden substantive draw on your working capital (money in the business that might be used for other expenses or to pay up front for job materials).

- You may decide to take a loan in order to purchase this equipment. Allow the cost of the loan in your calculations.

- This purchase is an investment so you have to determine how long it will take for this asset to start paying for itself and when it will have paid for itself through productive usage and allocation of costs from each job it participates in.

Hire items

This is equipment you hire for each particular job and would be itemised as an expense to be added to that job when calculating your costs and quoting your customer. Sometimes, the cost of hire can be allocated across more than one job if the equipment is with you long enough.

Asset purchase v hire

Deciding to purchase or hire is likely to depend on the following:

Cost of ownership purchase + maintenance cost

v

Cost of hire x expected frequency of hire

In each case, you can assume a three or five year cycle; although this also depends on how hard you work the asset and the warranty agreement in place for the item.

Advantages of buying

- The item becomes an asset on your balance sheet.

- Depreciation of the asset can be claimed against tax.

- No time cost in having to collect and return the tool to the hire company.

- You have the item available when required (no risk of the item not being available from the hire company).

- Risk of losing part or all deposit placed on hiring equipment due to accidental damage.

Advantages of hire

- No need to allocate resources to maintenance; although service and warranty agreements could provide a similar advantage when buying.

- No long-term storage required.

- No outstanding loans (liabilities).

- No security risk against loans required for buying.

Borrowing money to purchase tools and equipment

There is obviously a vast range of loan options out there; all with varying degrees of costs and required security. It you allocate security to a loan for this equipment then that security will not be available for any future loan you might require in the future for something else – such as raising working capital. In other words, that element of your asset resources could be tied up until the loan is paid.

Seek professional advice before making any final decision on finance.

Leasing

Leasing is similar to hire but the equipment is with you long term.

There are many types of leasing deals out there. Some offer lease then own packages. Some appear quite complex. You need to fully understand exactly what the deal is and for how long you will be tied into that deal.

Seek professional advice from an accountant or lawyer before committing yourself.

Consumables

These are items that are consumed while using the tools and equipment you own.

Examples: drill bits, computer print cartridges.

In accounting, consumables are considered as expenses.

Choosing a supplier

Choose a supplier with a good range of the products that you might need when the business is up and running. Ensure also that they have and foresee a reliable stock of consumables. You do not want to be wasting valuable time re-sourcing when you are busy servicing customers.

Ideally, you need two or three similar suppliers as backup – particularly for the consumables.

Keep local if you can

You may not have the time to replace or send faulty items back to sellers by post to some far off supplier when running a business. A good local supplier that you can meet face-to-face for advice and who can deal with problems and resupply promptly is likely worth the additional cost when compared to money you might save if buying on the internet.

Future proofing your equipment

It is worth asking your supplier about availability and future availability of spare parts before you actually purchase.

Try to avoid end-of-line items in that spare parts are likely to stop being supplied sooner rather than later.

With product life cycles generally becoming ever shorter, finding products with any form of future commitment is proving ever more difficult.

Nevertheless, end-of-line items should be avoided unless they have been around for a long time and are generally used.

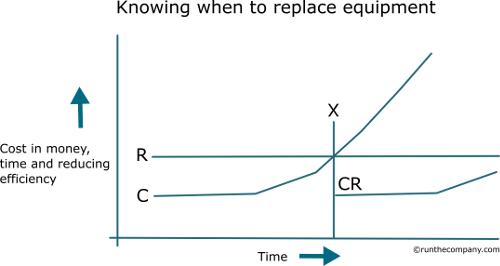

Knowing when to replace equipment

It is important to get your money’s worth from all assets within your business. This is called “sweating the asset”. Sometimes, this adage can be overplayed and keeping with constantly malfunctioning equipment or compromised performance can be a false economy.

Keeping with assets in order to spend less money is also likely to make you less efficient and capable than your competition.

In fact, there is a simple analysis to determine the optimum time to replace equipment.

Understanding cost variables when deciding to replace tools and equipment

Below does not involve particular accounting procedures. It is simply a useful introductory insight into some of the variables when deciding to replace equipment.

C Curve

As time goes by and the equipment wears out due to usage then the cost in time and money to maintain the item and the cost in reduced performance provides the increasing cost curve – shown above as C.

This is the Compromised Efficiency Cost Curve and is demonstrated above on a monthly cost basis.

R Line

The R Line offers a monthly average of the estimated monetary cost/benefit of replacement and includes the following:

Expected additional costs

- Purchase price for the new equipment and cost of finance: The total monetary cost of the replacement (including any costs of loans) divided by the expected number of months this item is expected to perform.For example, if the replacement item costs £1200 (including cost of finance and monetary switch costs) and is expected to perform for 4 years, then the basic R line will sit at £25 (£1200/48 months).

The C Curve would also contain such costs due to the previous purchase of the current equipment.

- Switch cost disruption: Installation costs, production disruption and training on how to use new and updated equipment. This additional element of costs is what makes the R Line stand above the C Curve until the current equipment starts to become too expensive to maintain.

LESS – expected cost benefits

Subtract the following estimated cost-benefits from the R Line (allocated as monthly averages over the defined period).

- Any part-exchange or resale value of the old equipment.

- Any production efficiency gains from replacing the equipment.

- Reduced running costs gained by replacing this equipment.

Note that the R Line remains straight (constant). This is because the R Line does not contain any evolving wear and tear costs. The R Line is simply the monthly average additional costs and cost efficiencies to you if you decided to replace your existing equipment (the lost opportunity of enduring or enjoying a different cost situation).

X Point

This is the point in time when it is more cost and time efficient to replace the item.

CR curve

At the X Point, the CR Curve replaces the C Curve and the process starts all over again due to the previous equipment being replaced with new equipment.

Note that any part-exchange or resale value of the old equipment needs to be taken from the new CR Curve total.

Include in your business model a budget for asset replacement

Budgeting for equipment replacement and estimating when this is required is therefore important; otherwise you may get a false sense of profit and how well your business is actually performing.

This also means you will be taking less of a cash flow or liability hit when the time comes to replace equipment.