Balance sheet examples – an introduction

The concept and construction of the Balance Sheet

Examples of balance sheets and how they are constructed are shown below.

After reading this carefully you should have a basic understanding of the balance sheet and why it is crucial to knowing the current financial state of your business.

The balance sheet provides a statement of financial position and is a snap shot of the financial state of the business (unlike the Income Statement which considers a particular period of time – for example May 2019 to April 2020).

With the advantage of accounting software, you can run a Balance Sheet report at any time, but usually they are published annually for presentation to relevant interests such as shareholders and Companies House.

The elements and structure of the Balance Sheet

The clue is in the name in that an accurate Balance Sheet by its definition will: balance.

Simple balance sheet – horizontal layout

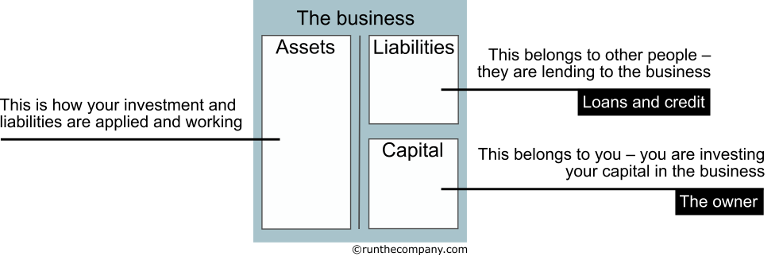

A Balance Sheet therefore has two sides.

- Assets

- Liabilities + Capital

in other words:

Assets = Liabilities + Capital

in other words:

Assets employed for the operation of the business = what is owed to others plus what is invested by owners.

So here is the odd thing you need to get your head around: What is invested by the owners (Capital) appears on the liability side of the Balance Sheet. From the perspective of Balance Sheet reporting, Capital is a liability to the business.

This is because in corporate world, a limited company is a separate entity. You may own the company, but it is still a separate entity. See it much like a child to which you are the parent. It might be your baby but the baby is still an individual.

This means the capital in the business is invested as equity by the owner. Note that Capital is a generic term for Equity (investment by the owner/s) and Retained Earnings (profit and other sources of net income due to company activities).

Simple visual explanation of the three sections that make up the Balance Sheet.

The definition of “You” here is the owner or owners or shareholders.

A liability usually means something of contributing worth (asset) has been purchased to be productively employed inside the business. This could be equipment, stock or anything that contributes to the activity of doing business and hopefully profit generation.

The consequences of liabilities in the form of assets therefore appear on the left asset side of the Balance Sheet. There could also be a transitional dormant asset such as cash.

If you bought the “something of contributing worth” on credit then that amount will also appear on the right liability side of the Balance Sheet. The amount you pay off (assuming that depreciation has not wiped it out) then converts to capital because you now own it.

If you purchased that asset with cash then the cash amount on the asset left side would reduce and the something of contributing worth asset would increase. In other words, there would be a change in amounts within the asset side with nothing affecting the liability side of the Balance Sheet. You have converted a liquid asset (inert cash) into a productive Fixed Asset such as a machine or Current Asset in the form of stock that has the task of now selling at a profit.

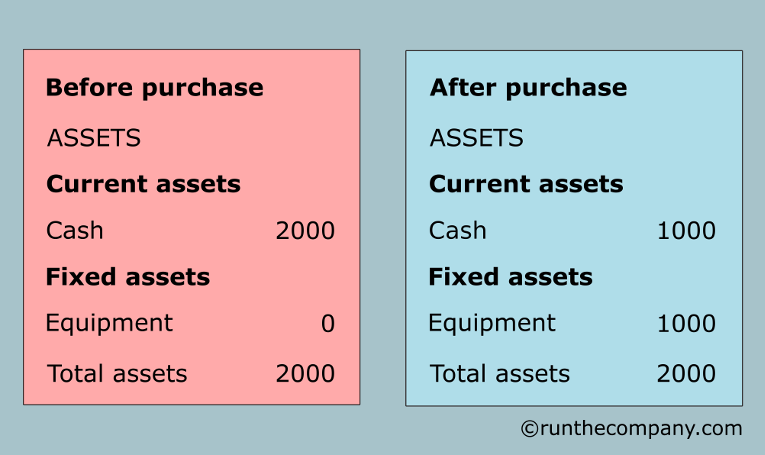

Example: buying an asset for cash

ABC Ltd purchases a widget2000 machine for £1000 cash.

The image above illustrates what happens to the left asset side of the Balance Sheet.

Before the purchase is shown in pink.

Notice the Cash at £2000 but no equipment yet purchased at zero amount.

After spending £1000 of your cash on equipment shown in blue.

Cash is now down to £1000 and equipment is now £1000.

Notice your total assets at £2000 both before and after the purchase have not changed.

It is the monetary amounts allocated to the items within the balance sheet that have changed.

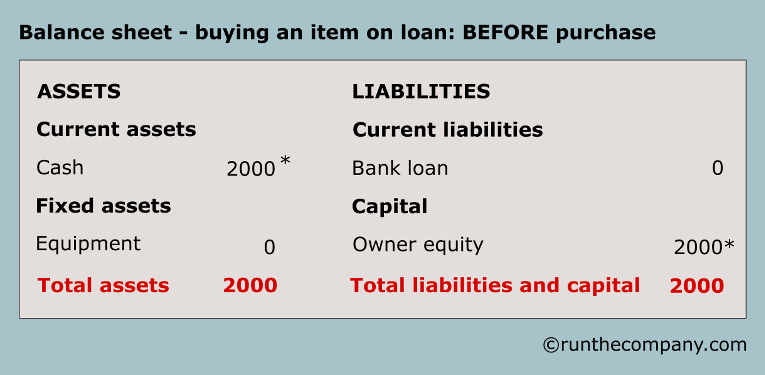

Example: buying an asset on loan

Below is what happens to the asset and liability sides of the Balance Sheet when you purchase assets using a loan.

ABC Ltd purchases a widget2000 machine for £1000 using a 12 month loan from the bank.

Note that the cash belongs to the owner as equity in the business*.

Note that the owner equity in the business does not change.

This is because the Equipment asset is matched by the liability of the bank loan *.

Can you see how the total amounts on each side of the Balance Sheet always match.

Understanding the typical elements of a Balance Sheet

An easy reference to common Balance Sheet elements

Note that summary monetary amounts are usually provided in most sections of the Balance Sheet with a further breakdown in a separate “Notes” section. For example, in the Liabilities – Current liabilities – tax section below, there would be a separate note explaining how the total figure was reached.

Remember: Assets = Liabilities + Capital

| 1 | Assets |

| Assets is a generic heading on the left side of the Balance Sheet under which Current Assets and Fixed Assets are placed. | |

| 2 | Assets > Current assets |

| These are assets that are variable or short-term. | |

| Some specific examples are shown next: | |

| 3 | Assets > Current assets > Cash |

| Cash in the bank or at hand. This is a liquid asset that is waiting to be converted to something of contributing worth to the business. Note though that cash is the lubricant of the business: too little cash and the business seizes up; cash flow issues have sent both great and bad businesses down the same chute. | |

| 4 | Assets > Current assets > Accounts receivable |

| Accounts receivable is outstanding money owed by customers who have purchased from you on credit. Remember the Balance Sheet is a snap shot at a specific point in time. This means this amount is at that point in time and not a cumulative amount over a period of time. | |

| 5 | Assets > Current assets > Inventory |

| The value of stock, work-in-progress, materials, paper, printer cartridges – at the point in time at which the Balance Sheet represents. | |

| 6 | Assets > Current assets > Short-term investments |

| Usually company investments of less than one year. | |

| 7 | Assets > Fixed assets |

| These are assets that are not variable or temporary – usually within a year. | |

| There are tangible and intangible fixed assets. | |

| Note that these titles can vary slightly according to preference. Some specific examples are shown next. | |

| 8 | Assets > Fixed assets > Tangible |

| As a rule of thumb, tangible assets are things you can touch, kick and sit on. | |

| 9 | Assets > Fixed assets > Tangible > Equipment |

| The monetary value of things such as machines, tools, computers and mobile phones. | |

| 10 | Assets > Fixed assets > Tangible > Vehicles |

| The monetary value of vans, cars. | |

| 11 | Assets > Fixed assets > Tangible > Land and buildings |

| The monetary value of buildings and land actually owned by the business (not what you rent as this would be an asset owned by someone else). | |

| 12 | Assets > Fixed assets > Intangible |

| Intangible fixed assets are advantages the business owns to which a monetary value can be placed. | |

| 13 | Assets > Fixed assets > Intangible > Goodwill |

| Quantifying Goodwill on the Balance Sheet is a complex and much debated subject. Goodwill represents the premium for buying a business for a higher price than that supported by the identifiable assets of that business (GAAP). This means the Goodwill amount is only proven when someone pays more for the company than the Capital section on the Balance Sheet suggests it is worth. Reasons for this include: a good and stable customer base, commercial and technical potential, brand properties etc. | |

| 14 | Assets > Fixed assets > Intangible > Intellectual property rights |

| Patents, trademarks, website domain names etc. | |

| 15 | Assets > Fixed assets > Intangible > Investments |

| Fixed asset investments are those investments by the business on terms longer than one year. They cannot be made liquid in the short term (turned into cash). | |

| 16 | Total assets |

| This is the total of all Current and Fixed Assets in the company and appears at the bottom of the left side of the Balance Sheet. | |

| 17 | Liabilities |

| Liabilities is the generic heading on the right side of the Balance Sheet under which Current Liabilities and Long-term Liabilities are placed. | |

| 18 | Liabilities > Current liabilities |

| These are liabilities that are variable or short-term. | |

| 19 | Liabilities > Current liabilities > Accounts payable |

| This is the total amount of money owed to suppliers due to purchases made on credit at this particular point in time. | |

| 20 | Liabilities > Current liabilities > Short-term loans |

| Bank overdrafts and usually loans of less than one year. | |

| 21 | Liabilities > Current liabilities > Tax |

| Tax expected to be paid within the given year. This includes VAT, National Insurance, PAYE (Pay As You Earn Income Tax) and Corporation Tax. | |

| 22 | Liabilities > Long-term liabilities |

| Loans to the business of longer than one year. Examples: banks loans and other financial agreements and director loans. | |

| 23 | Total liabilities |

| This is the total of all Current and Long-term liabilities for the company and appears at the bottom of the right side of the Balance Sheet. | |

| 24 | Capital |

| A generic term that includes such as Equity and Retained Earnings. | |

| 25 | Capital > Equity |

| The amount invested in the business by the shareholders (owners). | |

| 26 | Capital > Retained Earnings |

| Funds generated from business activities that is kept within the business after all other payments including dividends have been made. | |

| 27 | Capital > Reserves |

| This is money put to one side and earmarked for a specific purpose such as precautions against future loss, reducing liabilities or replacing depreciated assets. | |

| 28 | Total Capital |

| This is the total of Equity, Retained Earnings and Reserves. It is an indication of the literal value of the business. | |

| 29 | Total Liabilities and Capital |

| This is the sum monetary value of the ownership of the assets as presented on the left side of the balance sheet. |

Balance Sheet layouts

The Balance Sheet can be horizontal in layout or vertical.

The vertical option is more common.

So what insight into your business does the Balance Sheet give you?

There are numerous ratios and accounting analytics you can use to assess what is really going on in your business.

Click for Financial Accounting Ratios

But in summary, the Balance Sheet provides:

- The monetary value of owner investment: shown in the Capital section of your Balance Sheet.

- The monetary total value of assets employed in this business endeavour: shown in the Asset section of the Balance Sheet.

- The amount of funds in your business that belong to someone else: is totalled in the Liability section of your Balance Sheet.

- The monetary value of the business is determined by taking the net value of Assets minus Liabilities. This is the Book Value. Note that the perceived value of a business due to its potential or other strategic reasons cannot be listed in financial statements. After all, what a business is ultimately worth depends on what someone is willing to pay for it.

How to use your Balance Sheet as a guide to how effective you have been

- Comparing your Balance Sheet to previous Balance Sheets will indicate good and bad changes and trends.

- Assess your Balance Sheet against business objectives and the consequences of your business strategy.

- Analysing competitor Balance Sheets and comparing them to your own will indicate strengths and weaknesses.

- Consider your budgeting activities and how effective these have been.

- Examine your business investment projects and consider the impact of these on your Balance Sheet.