Cashflow in the business

Always seek advice from an accountant when developing cashflow strategies and managing cashflow.

Before we get into the behaviour of cashflow in business, let’s take a look at cashflow statements.

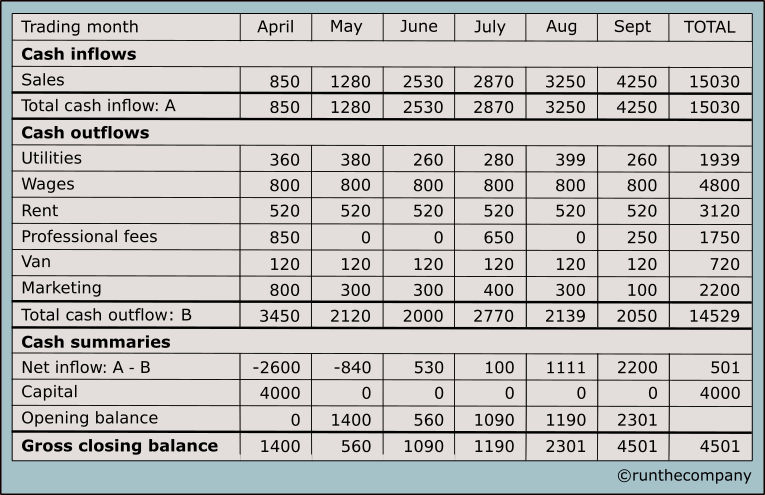

There are basically two types of presentation of cash flow in a business: the cashflow forecast and the actual or historical cashflow statement.

Cashflow Forecast Statement

The Cashflow Forecast is a common term used in business and is designed to assess expected cash events and circumstances that may occur over a defined period of time. This is usually presented on a scale of 12 months.

A spreadsheet is the common tool.

The cashflow forecast considers the movement of cash into and out of the business. It lists each item and its cash effect. This means that for each month, there is a summary line stating the amount of cash left in the business after all cash has been collected from customers and all obligations have been met.

This amount is then carried over and added to or subtracted from the cash available for the next month. It is important to note the positive or negative cumulative affect this can have over time if circumstances remain constant.

This cashflow forecast is then evolved until a working cashflow strategy is reached. For example, if you discover that in the next year, you may have negative cash over two particular months (e.g. July and August due to holidays) then you can take action to cover that period.

You might decide to make arrangements with your bank to enable an overdraft facility to cover the expected amount (also allowing for an additional budget overdraft facility – just in case).

Alternatively, you may amend your business activities and strategy to counter a potential excessive or consistent cashflow problem.

Shown below is a copy of a simple cashflow statement taken from a spreadsheet.

Historical and Actual cashflow statements

A Historical cashflow is a record of cashflow over a previous period. Examining historical cashflow statements provide invaluable insights and enables a more accurate cashflow forecast for the next period.

Keeping a clean copy of your initial cashflow forecast and then comparing this against the Actual cashflow statement (what actually took place) will indicate how good you are at the activity of cashflow forecasting.

Perhaps you were over optimistic, perhaps you were not fully aware of all the demands on cash or you were spot on. Comparing your performance against forecast is a reality check that enables you for the future.

Important concepts to remember when managing cash flow in your business.

There are almost peculiar characteristics in the way cash behaves in a business and it is worth being aware of these to ensure you maintain control over circumstances and potential situations.

Examples

| 1. | There is no immediate correlation between high profit and the amount of cash in your business |

| Higher net profit potentially brings in more cash than you started with – eventually. When you get this cash depends on your customer payment model. In other words, a high profit sale has no relationship with cashflow until the customer pays and the cash is actually in your account. | |

| 2. | A growing business requires more cash |

| It is tempting to think that more sales generates more cash for the business. But it is often growth that can starve the business of cash. A fast growing business requires particular attention to its cashflow.

For example, growing sales can mean buying in more stock. This is more cash taken out of the business and transformed into stuff in boxes on shelves. You still have bills to pay and your suppliers and employees are not interested in being paid with boxes of stuff: they want cash. Those boxes remain as stuff until they are converted back into cash (increased amount of cash depending on your profit margin). Remember that converting stuff back into cash occurs the moment the cash hits your bank account from a customer and not at the time of the actual sale. You also have more wages and overheads to pay which places further demands on available cash. |

Examples of how cash moves in and out of a business

The runthecompany Cash Flowchart is a visual technique to demonstrate the behaviour of cash into and out of a business and how it can catch you out.

This Cash Flowchart isn’t as complicated as it might look. Read the text below carefully; it will provide an insight into how cash operates within a business.

The circle of cashflow life

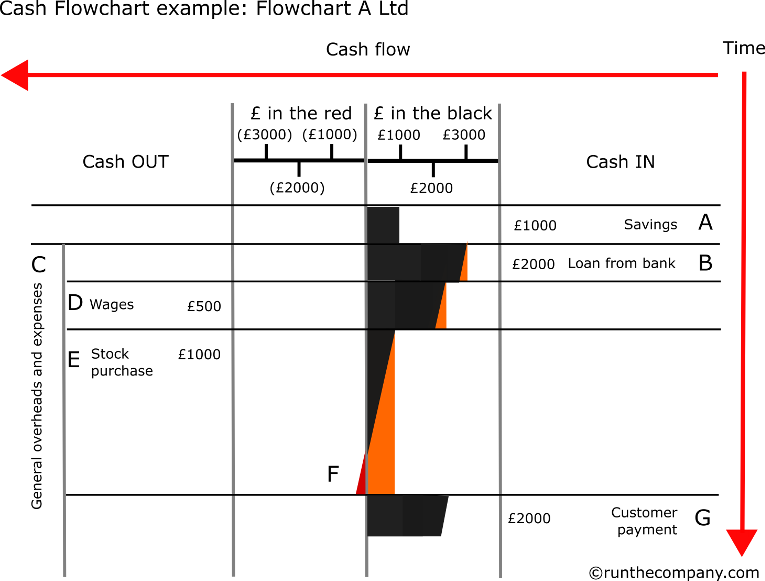

Flowchart A Ltd

Flowchart A Ltd above is a simplistic summary of cash items using the runthecompany Cash Flowchart.

Cash events

| A | The business starts with your savings of £1000. You now have £1000 cash in the company. |

| B | You think ahead and add another £2000 to the cash pot with a bank loan. For the moment, you are on the black side of the chart to a total of £3000. |

| C | Cash starts to drip away almost at the start of business. On the Cash Flowchart, this is indicated by the creeping away of the black towards the left and indicated in orange. The cash leaving your business is being spent on overheads and interest on your initial bank loan.

The time periods shown on the Cash Flowchart are not to scale. Moments in time are indicated here only by cash events. The dripping away of cash through overheads is the only indication regarding the scale of time. In other words, in business, time really is money. |

| D | You are now at the point in time where you pay wages. The cash therefore drops to the left by another £500. |

| E | You then buy stock for £1000. You may have purchased for cash or on account for payment at a later date. This analysis takes the moment the stock is actually paid for.

What is important is limiting the time period between releasing cash out of the business for stock purchase and receiving increased cash in the form of payment from your customers. In the meantime, you are losing cash on an unforgiving and relatively constant level due to the payment of overheads, expenses and wages. |

| F | In this example, the time period between paying out for stock and receiving increased cash (due to profit) is too long and you go into the red. This means you might have to arrange a cash overdraft with the bank to meet short-term cash payment obligations. |

Investment can also mean delivering adequate cashflow

In the example above, you might have chosen to put another £300 of your personal money into the business.

This means investment into a business isn’t just about asset expenditure on things such as machines. It is also ensuring adequate working capital and cash.

This is particularly important when a business is growing and can be the cause of collapse when a business is growing too fast.

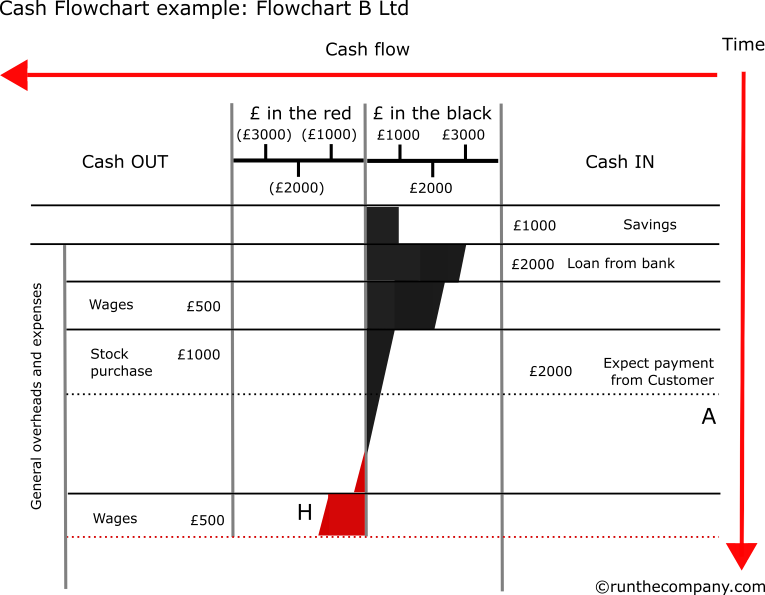

Flowchart B Ltd

| A | The example above is similar to Flowchart A Ltd, except that the payment of £2000 from the customer is delayed. |

| H | This means you now also have the next round of wages to pay, on top of the general overheads. The red amount is getting bigger. You have to find £1000 to keep the business going in the short-term – even though you have successful high profit sales of £2000. If you cannot raise the £1000 then you are either going to be late paying bills and wages or the business might even have to close. |

Cashflow management also means buying and selling right

Two important things to negotiate when buying: price and long payment terms.

Two important things to negotiate when selling: price and short payment terms.

Companies therefore push for extended payment terms from suppliers and tighter payment terms from customers. This helps towards gaining a positive cashflow.

Additional things to be aware of

| 1. | Everyone should be trying to do the same thing |

| You are a supplier to your customer and you are a customer to your supplier so everyone is or should be trying to do the same thing to each other.

Some companies are more astute and eager to credit control their business than others. The key here is to be aware of the credit terms and the variables when buying and selling. |

|

| 2. | A major issue for start up and new businesses is getting credit terms from suppliers in the first place. |

| Many suppliers will only accept payment up front until a trading record has been established. You need to allow for this in your cashflow forecast and funds required to start up. |

Important

Always pay within the payment terms you have negotiated. Think of your business as being like a car. Keep a full service history and keep it well maintained and serviced on time.

Developing a reputation for being a well-run business that pays on time will deliver respect from your suppliers – and trust in business is important.

There is a difference between negotiating hard for extended credit terms and simply paying late.

You will gain more respect by negotiating hard then keeping to what has been negotiated.

Paying late puts doubt, worry and fear into a supplier who is also wrestling with its own cashflow issues. Chasing payments and managing that process is also a tremendous waste of time and distracts everyone from the real business of business.