Income Statement

The Income Statement is also known as the Profit and Loss Account or P&L Account and is a presentation of the trading performance (sales, costs, profit or loss) of the business over a defined period of time.

The Income Statement is one of the three key financial statements of a business (the others being the Balance Sheet and Cashflow Statement).

Important: Always consult an accountant before making or delaying any decisions.

The Income Statement is introduced below from the perspective of running a business.

We therefore seek insights and practical business management measures that can be taken when Financial Statements are presented by the accountant.

Reading and reviewing this ready reference will hopefully enable you to have constructive conversations with your accountant.

First we examine the various parts of the Income Statement and how it is constructed.

We then explore how the Income Statement provides a practical and productive insight into the performance of the business.

A simple introduction to the Income Statement

- The Income Statement summarises the trading performance of the business over a defined period of time.

- The Income Statement does not include assets such as cash in the bank or liabilities such as money owed to others because this Financial Statement is only about assessing the performance of actual trading.

- The Income Statement is usually prepared annually as part of the financial accounts required to be presented to investors and as a UK Limited Company to such as Companies House. However, running a rolling monthly Income Statement will enable greater insight as to the financial performance of your business. Accounting software more readily enables this facility.

- Sole Trader businesses are not required to produce Income Statements (unless preparing a case for a loan or investment). To monitor the performance and progress of your business, running an Income Statement is good practice and achievable with modern accounting software.

How the Income Statement is constructed

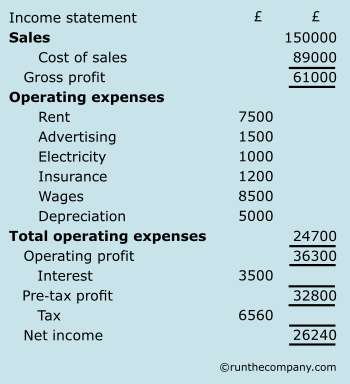

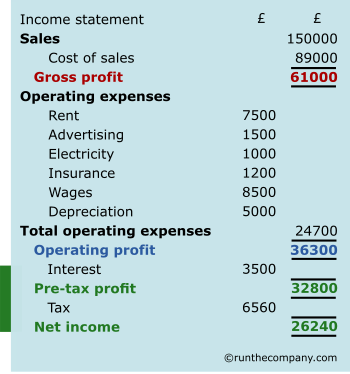

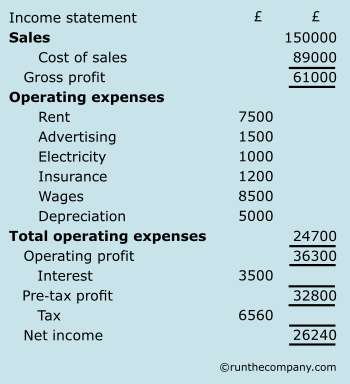

Below is an example of a simple Income Statement.

You will often find many additional elements added to a real-world Income Statement but for now, we’ll keep to this simple form.

Stages of profit presented in the Income Statement

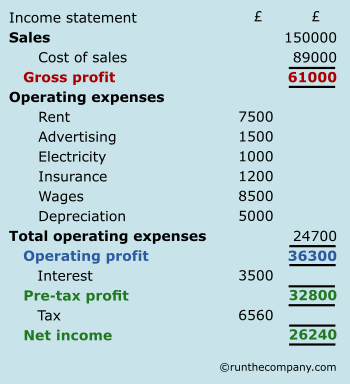

1. Gross Profit

Profit after cost-of-sales have been deducted from revenue (highlighted with red in the Income Statement example shown below).

2. Operating Profit

Profit after costs for keeping the business in existence have been deducted from the Gross Profit (highlighted below in blue).

3. Pre-tax Profit

Profit after cost of finance such as interest payments have been deducted from Net Operating Profit (highlighted below in green).

4. Net Income

This is what is left to either remain in the business and/or for distribution to shareholders (highlighted below in green).

You will notice that we have coded the Pre-tax Profit and Net Income with the same colour. This is because the main purpose of the Income Statement is to consider the trading performance of the business: Gross Profit and Operating Profit.

Nevertheless, Pre-tax Profit and Net Income are listed on the Income Statement for scrutiny. After all, owners want to know what is potentially available as a return on their investment.

What exactly is Net Profit?

You will discover on your travels that the term Net Profit is used loosely – for example Net Profit may actually be referring to Operating Profit, Net Operating Profit (or pre-tax profit) or Net Income.

However, the term Net Profit should refer to Net Income (the remaining profit after all commitments, including the payment of interest and tax, have been fulfilled). In other words, the money available for distribution to owners (e.g. dividends) and retained earnings for investment back into the business.

After all, tax and interest rates are the consequence of government policy and performance: these are variables your managers have no direct control over. Although it can be said that you or some within your business have made decisions that determine its financial structure and level of interest paid, the prime concern of the Income Statement is gaining an understanding of the ability of the business to return a profit from the resources applied.

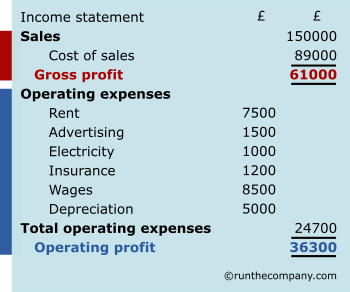

The Income Statement broadly consists of two sections

The upper section of the Income Statement provides the Gross Profit and is called the Trading Account.

This is shown below next to the red bar.

The lower section of the Income Statement provides the Operating Profit and is called Operating Expenses.

This is indicated below next to the blue bar.

Trading Account section of the Income Statement

Below are the elements that make up the Trading Account.

Sales or Sales Revenue

The Sales line within the Trading Account is sometimes referred to as Revenue or Sales Revenue but it means the same thing.

Sales is the monetary value of sales turnover of products and services for the period being presented. This is all sales, regardless of whether you have received payment from customers or not.

The Income Statement is therefore a measurement of actual trading performance and not an assessment of its ability to manage cash flow or credit control.

Cost of Goods Sold

The Cost of sales line within the Trading Account section (also referred to as Cost of Goods Sold or COGS) is money paid to produce or purchase the inventory spent in achieving those sales.

The cost of producing inventory typically includes:

- Materials used in the production of inventory sold in achieving these sales.

- Labour used in the production of inventory sold in achieving these sales.

- Cost of finished inventory purchased from suppliers sold in achieving these sales.

- Delivery costs to customers.

These costs are therefore allocated to the value of spent inventory (stock sold to achieve the revenue).

This includes any inventory you have received from suppliers and then sold whether you have yet paid for it or not.

Labour costs in the production of spent inventory

This is the cost of labour in producing the Goods sold. These costs are therefore allocated to the cost of each item that actually sold within the selected time period.

Calculating the value of inventory allocated to achieving these sales

Note that this calculation is only for the selected period of time.

Opening inventory (production value of inventory at the start of time period)

Plus inventory purchases (Inventory produced or purchased during the time period)

Less closing inventory (production value of inventory at the end of time period)

= Value of finished inventory allocated to Cost of Goods Sold (COGS).

Let’s consider each element in turn.

- In the example above, the company started the period with £49,000 worth of inventory. This is the net value of inventory before any markup is added.

- During this period, the company purchased or produced another £70,000 worth of inventory. Again, this is the net value before any markup is added.

- The opening inventory of £49,000 is added to the value of additional inventory purchased within the time period of £70,000. Therefore £49,000 + £70,000 = £119,000.

- At the end of the period, inventory still within the business totalled a net value of £30,000.

- This net value of inventory remaining within the business at the end of the time period of £30,000 is deducted from the total of £119,000. This provides a figure of £89,000. This is Cost of Goods Sold (COGS)

- The Cost of Goods Sold (COGS) of £89,000 is then deducted from the revenue or sales figure of £150,000. This provides a Gross Profit of £61,000.

Lower section of the Income Statement: the Operating Expenses section

The lower section of the Income Statement contains the Operating Expenses for the time period. Deducting the total of these Operating Expenses from the Gross Profit provides the Operating Profit.

Operating Expenses is sometimes referred to as OPEX (OPerating Expenses).

The expense items within the Operating Expenses section is sometimes referred to as Selling, General & Administrative Expenses (SG&A). This includes all costs to the business that do not directly relate to Cost of Goods Sold (as covered in the upper Trading Account section of the Income Statement).

Consider these lower section costs as the generic costs required to keep the business in existence; without which the company would not exist in order to enable the Trading Account or upper section of the Income Statement to take place.

Typical expenses within the SG&A section of an Income Statement

Advertising

Insurance

Professional services

Rent

Business rates

Marketing

Telephone

Electricity

Wages

Depreciation of assets

Bank and finance costs

The Operating Profit is therefore Gross Profit less Operating Expenses.

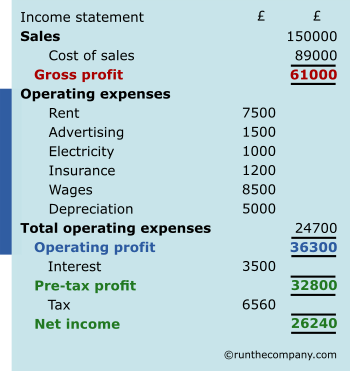

Pre-tax profit and Net Income

Pre-tax Profit is what remains of the Operating Profit after Interest or Cost of Finance is deducted. This is the cost of any loans taken by the business in order to finance its operations and does not contribute to the assessment of trading performance.

The amount of financial cost does however consider the impact on Profit of the financial servicing decisions taken by directors – allowing of course for the prevailing climate of interest rates in the economy.

Net Income is, in its truest sense, the Net Profit remaining after all commitments have been satisfied (except for the expectations of investors as regards return on their investment).

What to do with this Net Income as to the ratio of keeping this money for reinvestment back into the business (Retained Earnings) or paying dividends to shareholders is a decision for the directors.

Where the figures for the Income Statement come from

All the figures for the Income Statement come from the bookkeeping that was on-going during the operation of the business.

The Books or Ledgers will cover the time period for which the Income Statement represents.

The Books will be closed off at the end of the time period and it is the balance of these Ledgers that are stated in the Income Statement.

Not all the Books are represented in the Income Statement. Only those showing a balance for either revenue, inventory purchases or expenses are relevant to the Income Statement.

Those Accounts representing assets (including cash and equipment bought, owner capital or liabilities such as debts owed by the business) will provide figures for the Balance Sheet.

The Books that contribute figures to the Balance Sheet are not closed off because the items and their value remain in the business beyond the accounting period being considered.

The Trading Account section will receive figures from such as the Sales and Purchases Accounts.

Note that the Purchases Account only logs items bought for resell. This means the Purchases Account accurately contributes to the Trading Account section.

The Operating Expenses section will contain Expenses and from a Ledger perspective, will contain separate accounts for each definition of expense: examples include Rent, Telephone and Electricity.

Practical applications of the Income Statement for the business owner

The Income Statement is not just a financial accounts formality that has to be completed, endured and paid for by giving up good money to an accountant.

The wonderful thing about the Income Statement is that it is a summary of all trading and expense transactions that have been logged and processed through the everyday activity of bookkeeping: transactions that now demonstrate the trading performance of the business for that time period.

For an on-the-ball business person, these figures tell you a lot about the business and how effective all your efforts, fun and heartache have been over that time period.

Consider each cost and the revenue generated as variables that have consequences for each other. It is their interaction that has contrived to produce this Income Statement. Each tell a story of success, failure, missed opportunity and potential.

Measuring business performance

Whether these profit figures and the elements within the Income Statement that have contributed to those figures are good, bad or indifferent requires the Income Statement to be compared against something that can provide perspective.

In other words, points of reference.

Gaining business performance insight from the Income Statement

Below are typical actions taken during a trading period and how the Income Statement provides insight as to their consequences.

We also briefly consider measures that might be taken to influence the next Income Statement.

Increased sales

Achieving an increase in sales and the extent to which you can control costs to achieve or fulfil those sales will dictate the level of profit.

Increased sales may potentially offer Cost of Sales efficiencies (bulk discounts when buying larger amounts of purchases such as inventory or materials).

However, you may have had to also take on more staff to fulfil those orders and manage a larger business.

This means an increase in overheads and a reduction in Operating Profit.

A sudden increase in sales may therefore mean larger Gross Profit but lower Operating Profit.

Economies of scale in Cost of Sales and overhead costs can limit and even reduce costs. (Economies of scale is the resource efficiencies gained due to increased output.)

Example of a cost efficiency measure in response to higher sales

Pay overtime rather than employing more staff: therefore saving on recruitment, induction, training and additional employment costs.

Example of an economy of scale measure in response to higher sales

Work high-cost fixed assets such as expensive machinery 24 hours day rather than just 8 hours (sweating the asset).

Reduced sales

A reduction in sales due to lower market activity or increased competition will also mean reduced Cost of Sales. Unspent stock and its allocated Cost of Sales are by definition taken out of the COGS equation.

The Income Statement only considers active or spent stock (stock sold to create the sales within the time period).

But this is not the case for the Operating Expenses section of the Income Statement. If operating expenses have not or could not respond to a lower revenue performance then this will have an impact on Operating Profit.

Increasing prices – offensive measures to increase profit

An increase in prices that are not in response to increased costs could deliver increased Gross Profit if unit sales either remain the same or reduce only to a point where relative profit is still increased.

How successful this will be depends on either increasing demand in your market and how inelastic demand is to your price rises (how insensitive demand for your product is to price changes).

In other words, there is no point in increasing prices only to wipe out profit due to lower sales.

An increase in prices may deliver cost advantages if less stock is required (Cost of Sales) to deliver that revenue – assuming there are no adverse effects on economies of scale or stock purchase discounts.

However, Operating Expenses often contain inflexible fixed cost elements such as rent and wages (these same costs must therefore be supported by the potentially lower amount of units sold).

Operating Expenses may even increase due to the additional investment in marketing and advertising required to maintain a price premium position in the market (convincing your customers that these higher prices still offer value).

Inversely, if higher Gross Profit can be made from acceptable lower sales through less Cost of Sales employed and at the same time, elements within Operating Expenses can be reduced due to their ability to be flexible and therefore variable then higher Operating Profit can be a realistic objective.

Be aware though that there is a fine line between efficiency and retrenchment: removing platforms for growth can deliver gifts of strength to competition. You still need soldiers to win battles.

Reducing prices – offensive measures to increase sales

A reduction in price may provoke an increase in sales that then takes advantage of inventory purchase discounts or economies of scale in producing stock within the top Trading Account section of the Income Statement.

Be aware though that Operating Expenses in the lower half of the Income Statement would or should have been optimised or near optimised to previous turnover and rarely react quickly or favourably to increased activity that is not accompanied with corresponding profit.

Also be aware of provoking competitor reaction (price countering from competition) where performance advantages shown on the Income Statement may only then be short term due to an evolving market situation that simply pushes sales back to previous levels but now with lower Gross Profit.

Increased costs

Increased Cost of Sales:

If revenue remains the same and Cost of Sales increase then you will have lower Gross Profit compared to previous Income Statements.

Causes can include increased cost of inventory, labour or any other direct cost allocated to inventory. You need to work on reducing costs within Cost of Sales or if that is not possible then you have to look down the Income Statement and seek cost efficiencies within Operating Expenses.

Increased Operating Costs:

Increases in costs such as rent or wages will affect Operating Profit and consequently Pre-tax profit and ultimately Net Income. On the Income Statement, Gross Profit will be unaffected. You either have to accept lower Operating Profit or seek cost savings elsewhere either in the Cost of Sales section or somewhere within Operating Expenses.

Cutting back on the source of the cost increase is one option (although this is not often possible for costs such as rent – unless of course you move premises). Increasing efficiency is another option: although be careful not to compromise a successful element of your business that could result in operational inefficiencies (meaning increased costs or lower sales) even though seemingly immediate financial efficiencies were achieved.

Other than living with lower profit, an increase in prices may be the only other option and the success of that strategy from the perspective of sales will depend on market variables such as competition pricing and positioning, customer ability to pay and the state of your industry sector.

However, to increase prices in reaction to increased costs has to be carefully considered. Next we briefly examine why.

Passing increased costs onto price

Simply passing costs to customers could mean lower orders due to customers switching to competitors or substitute (alternative solution) products. A lot depends on whether increases in costs are particular to you or generally applying across your industry. Even if price increases are generic, demand may simply drop if customers decide to buy substitutes or simply not buy at all.

There are additional ramifications to be aware of when cost driven price increases have an adverse affect on unit sales turnover. For example, lower unit sales could have an affect on economies of scale within the top Trading Account section of the Income Statement (compromised purchasing discounts and reduced cost per unit efficiencies within the production of stock). Note also that the Income Statement does not consider unsold stock (which may be increasing due to lower unit sales).

Lower sales also means less units to carry those inflexible costs in the lower Operating Expenses section of the Income Statement.

Price increases in response to higher costs could therefore provoke more cost increases in ratio to units sold and this loop of measures and reaction in chasing that elusive Gross Profit that once was, could mean a spiral down into a place of commercial and financial stress.

Reduced Cost of Sales

Reducing Cost of Sales will enable an increase in Gross Profit: at least in the short-term.

Be aware that the reasons behind a reduction in Cost of Sales will determine how good or bad this is to your business.

For example, if you have negotiated discounts with suppliers then this is good only in so far as this advantage is specific to your business. If this reduced cost is available to your competition then at some point there could be market pressure for prices to reduce. When this happens, you may get caught out by excessive Operating Costs which were geared for higher sales or simply expenses that bloated during the good times.

Reduced purchase prices may mean suppliers dumping items to enable restocking of a next-generation of technology or something similar. This means your Income Statement may only show a temporary wonderful moment before the reality of market irrelevant stock hits home on the Revenue line of the next Income Statement. Remember, only active spent stock contributes to Cost of Sales – not stock gathering dust in the warehouse.

Limitations of only using the Income Statement when assessing the performance of a business

COGS only considers spent stock that contributed to the revenue and profit of the business.

It does not consider inventory in the business that did not contribute to sales for that period.

Example:

The business might have used £50,000 of stock to produce a seemingly healthy Gross Profit of £40,000 but the additional £200,000 of unsold inventory that had to be purchased to get that amazing discount and therefore favourably low Cost of Sales is now imitating a mountain in the warehouse and is not part of the Income Statement analysis.

This £200,000 means cash frozen from use for the business and might also represent ineffective investment in purchases, labour, materials and storage.

This situation is made worse if the £250,000 of inventory was purchased on credit.

The opportunity cost (the cost of losing what else you could have done with the money) might also be a hit to the business.

This stock might be an even bigger issue if the market is now saturated or is not interested in buying. That stock is now a burdened to the business and a looming additional cost if it has to be discounted to sale. The next Income Statements may therefore not look so good with much lower Revenue due to lower prices, higher relative Cost of Sales and therefore lower Gross Profit.

The same applies to raw materials purchased as part of stock production.

In other words the Income Statement must always be considered with the Balance Sheet, Cashflow Statements and Financial Accounting Ratios.