Cashflow problems and why your cash isn’t coming home

It’s your cash but it’s staying out there – a prisoner to someone else’s situation: seemingly trapped on someone else’s island.

We take a look at how these cashflow problems sometimes occur and what you can do to both regain control and limit the chances of finding yourself in those situations.

Welcome to the world of business cashflow and most importantly the Payment Chain Analysis.

Always seek advice from an accountant when developing cashflow strategies or managing cashflow.

The Payment Chain Analysis (PCA)

The PCA has the potential to provide useful insights not only into why your cash is refusing to come home but it also offers a useful assessment at the feasibility stage of a business start up.

After all, would you be happy starting a business where customers take an age to pay? If you are willing to accept such a situation then at least you can plan adequate funds to carry your business over while waiting for that cash to come back.

The concept of the Runthecompany PCA is similar to buying a house in England where you might be waiting on a chain of other purchases to “complete” in order for your chosen house to become available.

Making a PCA assessment of any payment chain as part of your sales model will help improve your ability to develop sales strategies and agreements that will avoid the most strenuous of cashflow situations.

The process of a PCA is therefore to get you thinking about and potentially pinpointing reasons why there is a delay in cash coming back into your business.

Of course there may be other reasons; for example some companies may simply have a policy of delaying payments for as long as possible. But if this is true then you have the choice to either not do business with them, up your prices to include the cost of you providing a banking service to their finances or move into a sector that isn’t so mercenary.

At the very least, the PCA provides an opportunity for insight. You may find a good reason why cash is delayed or you will be enlightened as to a customer payment policy.

You can then take the appropriate action to avoid future cashflow pressures caused by delayed payments.

Think here of cashflow being all about the timing of payments.

It’s well worth taking 10 minutes to be studious and comprehend the PCA graph below.

This thing is a lot simpler than it initially appears and it does provide an insight into where and why your cash is taking its time coming home.

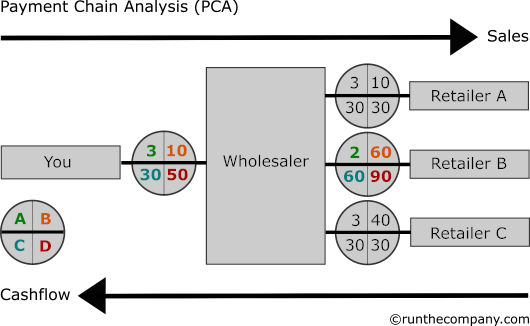

Take a look at the ABCD key at the bottom left of the above PCA example. This shows what each section within the circles means.

A: Annual rotation of stock

The annual turnover of stock is the number of times stock is completely rotated or replenished during the last financial year.

This is a generic financial assessment that does not highlight specific items that may be sticking. Nevertheless, this figure provides a good indication of a business’s overall stock turnover performance.

In the PCA example above, your immediate or Wholesaler Level 1 customer turned its stock over three times last year.

The wholesaler’s customer (your Level 2 customer) – Retailer B, turned over its stock twice during the same period. This is slower and means the Retailer B chain has its own cash tied up in boxes on shelves.

B: Percentage of business to supplier

In the above example your Wholesaler Level 1 customer accounts for 10% of your turnover. It’s not big but delayed payment can still cause issues depending on your available cash.

Given that 60% of your Wholesaler Level 1 customer’s turnover depends on the Retailer B chain then any delay in payment from Retailer B may have consequences as regards its ability to pay you on time.

It might even place the Wholesaler at risk and you don’t want your cash in that place if that Wholesaler goes pop.

C: Agreed number of days credit

This is the contractual number of days credit agreed at the time of sale. Your Wholesaler agreed to pay you within 30 days of invoice.

This could be because you demanded this as part of your cashflow requirements and the Wholesaler being eager to maintain a supply of your products agreed to this standard credit term.

In the example above, your arrangement with the Wholesaler is 30 days but your Wholesaler being keen to maintain its relationship with an important and large retail chain such as Retailer B and its reliability on the 60% of its turnover, agreed extended credit terms of 60 days.

The Wholesaler is now under cashflow pressure because it has agreed 30 credit terms with you but 60 days with its biggest customer.

How much pressure will depend on profit margins (negotiated sales price less overheads and cost of sales) and the ability of your wholesale customer to manage this money when it does come in.

D: Actual average days it took to pay.

This Wholesaler is actually taking 50 days to pay you. This is likely due to the delay in payment by Retailer B. Retailer B knows it is a big customer to the Wholesaler and being under pressure due to its own slow stock turnover is responding to the situation by delaying payment to 90 days.

It knows that the Wholesaler is likely to resist placing too much pressure on Retailer B due to the risk of losing future business.

To summarise, the Wholesaler you rely on for 10% of your turnover is taking an extra 20 days to pay over the agreed and planned 30 days.

In other words, this extra 20 days of free money to your Wholesaler customer is financing their “marketing strategy” of allowing an additional 30 days of free credit to keep Retailer B on board.

Depending on your own cashflow needs, you may or may not be happy with this situation.

What does all this tell us.

Commercial pressures often conflict with cashflow requirements.

Gaining an understanding of these commercial realities will enable you to plan more relevant cashflow forecasts.

How to find out information for a PCA

There is no harm in simply asking your customer about their customers. As you build relationships with customers then the amount of information you possess will grow over time.

The PCA offers a constructive framework within which to place and constructively assess this information.

The two variables that affect the cashflow chain

In any cashflow chain there are two variables that affect the efficiency of the cashflow process.

1. Agreed days of payment – intention

This is the agreed days within each node (participant) in the chain and in consequence, the total amount of days for that chain. Negotiating credit terms is an important part of negotiating. It is as important as price.

2. Actual days taken to pay – performance

This is the ability of each node (participant) within the chain to make payments to the agreed amounts and at the agreed times.

Confirming agreed payment terms with a customer without knowing or at least appreciating situations down the cash chain could mean an unworkable situation or at least an agreement devoid of reality.

Use the PCA to gather information on each cash chain participant and seek information on how many days each takes to pay their bills. You will then have a total number of days for that chain.

What this gives you

Total number of actual days to pay in your cash chain

minus

Total number of agreed days in your cash chain.

equals

Reality check

Typical variables that affect performance

Identifying and understanding the issues of not just your customer but those of all the participants in the cash chain will enable you to take the required action to limit your vulnerability.

Below are just some of the typical reasons why you or anyone within the cashflow chain is not keeping to the rules.

- Allocated resources: Not having the resources or inclination to process payments on time.

- Policy: A policy of holding payments back for as long as possible or prioritising only certain suppliers.

- Cashflow: Cashflow issues due to high overheads, growing too fast or diversion of cash for other priorities.

- Sales performance: Bad sales performance or unexpected bad sales performance meaning stock is sticking and/or income is not generating cash.

Managing your cashflow expectations

Knowing what is going to happen as regards payment of cash back into your business depends on the amount of information you own to make this assessment.

Using the PCA as a structure for this information and where possible completing the circles within the PCA will enable you to reach more realistic expectations.

The PCA can be both a forecast and a record of previous cashflow performance in your particular sales chain.